We provide educational credit in three easy steps

-

You apply online

The entire application process is online and will only take a few minutes to complete.

-

We make payment

If your application is approved we will make payment to the Educational Institution on your behalf.

-

The credit is repaid via debit order

Your repay the credit via a monthly debit order over a period that makes sense to you.

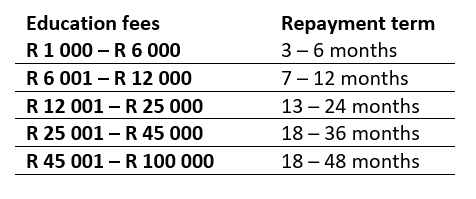

What is the payment term?

As indicated below, you can select the period over which you want to repay the credit. The term available is dependent on the amount you apply for.

What will my monthly payment be?

The tables below provide an estimate of what your monthly payment could be*. This is only an estimate and the actual monthly amount can only be confirmed once you complete your application.

Payment terms

6 month payment term

12 month payment term

24 month payment term

48 month payment term

*This calculation is based on a number of assumptions and should purely be used for indicative purposes

Frequently asked questions

-

If your application is finalised before the 15th of a month, the first debit order will be collected in the same month. If your application is finalised after the 15th of a month, the first debit order will only be collected the following month.

-

The credit assessment will be based on e-Fin’s credit granting rules, your personal credit profile and affordability. Applicants should be employed and receive a regular income.

-

You do not need any documents to complete your application, everything can be verified online.

Please note:

• e-Fin uses TrueID to verify your bank details. By choosing this option you will grant eFin read-only access to your bank transactions, which allows for a convenient, secure, and completely online application process.

If you choose not to use TrueID, you will need to submit your latest three months' internet bank statements (downloaded from online banking only, not scanned copies).

• In some instances, e-Fin might contact the credit applicant to request additional documentation, such as proof of residence, proof of employment etc.

-

To provide you with the most efficient service in providing credit for further education, we have partnered with e-Fin, a reputable instant credit provider.

-

You could qualify for up to R 100 000.

-

The credit will have to be repaid in full according to the credit agreement signed.

-

Yes. Credit can be settled any time before the end of the term upon request of an early settlement quote from e-Fin.

-

Interest rates vary depending on the applicant’s credit profile and can only be provided upon assessment of the application.

-

Yes, once your application is approved and verified the money will be paid directly to the educational institution.

-

• Affordability – you do not meet the minimum affordability criteria

• Low credit score

• You are under debt administration

-

You can contact SmartFunder if you are a potential student/credit applicant:

• and you have questions about your credit options, how the credit works; or

• you have any questions about the application process.

Contact: info@smartfunder.co.zaYou can contact e-Fin if you are an existing credit holder and:

• you have questions regarding your credit balance or debit order repayments; or

• you have queries about early settlement.

https://e-fin.co.za/contact/